JCPenney is proud to celebrate and support the women across our Company. From supply chain to logistics and management, we see women like Laurie Wilson – chief supply chain officer… [Continue Reading]

iMPOWER by Prabal Gurung for JCPenney Launches with an NYC Pop-Up

JCPenney, the shopping destination for America’s diverse, working families, and iconic award-winning fashion designer Prabal Gurung have combined style and quality with iMPOWER by Prabal Gurung for JCPenney, a versatile collection… [Continue Reading]

Honoring Women’s History with Hope & Wonder

Led by the JCPenney Creative Coalition, we are proud to introduce the next Hope & Wonder capsule collection in honor of Women’s History Month. Women’s History Month started as a weeklong celebration organized by… [Continue Reading]

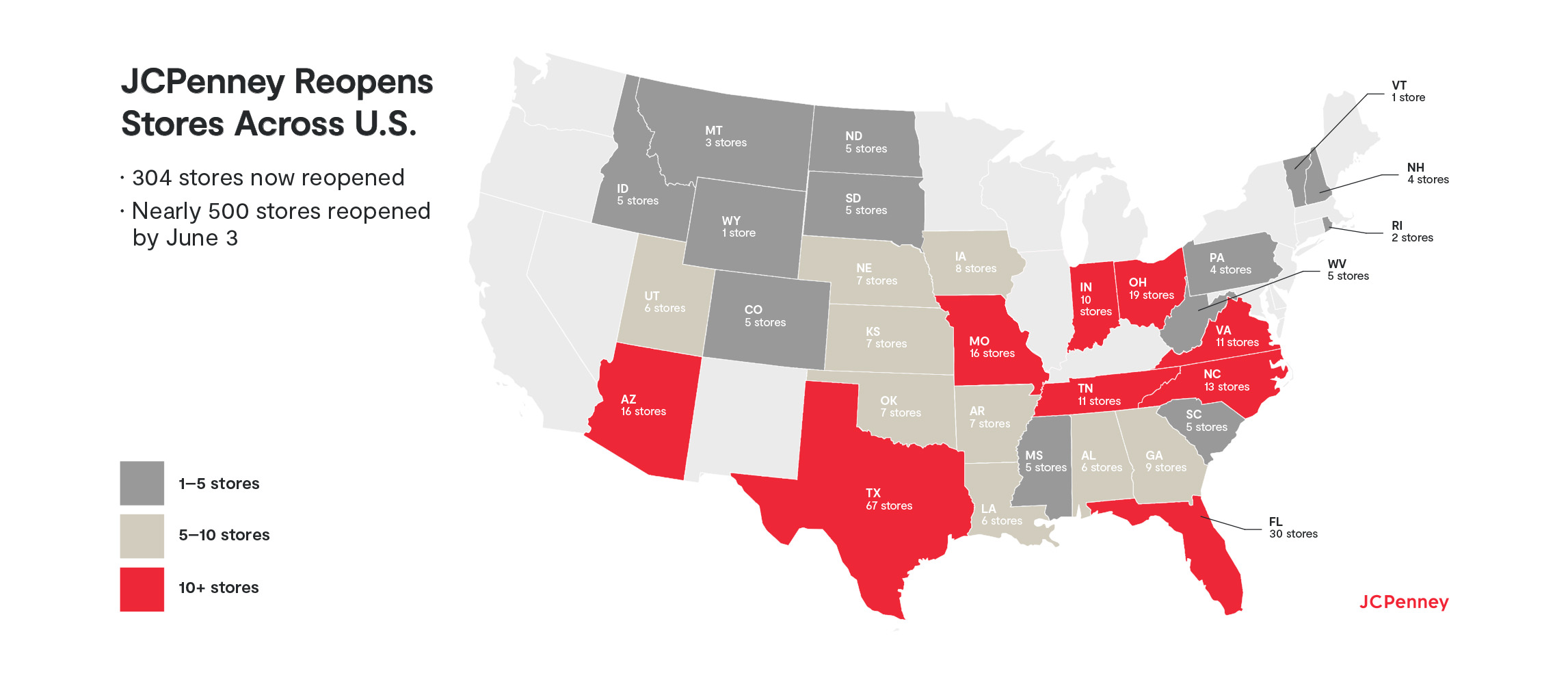

Nationwide Rollout of JCPenney Beauty Reaches its Halfway Point

JCPenney Beauty, the Company’s hyper-inclusive beauty experience, is now officially open in more than 300 JCPenney stores nationwide! This marks the halfway point to reaching all 600 doors by Spring… [Continue Reading]

Meet the Leader: Shenece Johns, Senior Director of JCPenney’s Inclusion and Diversity Team

At JCPenney, Inclusion and Diversity (I&D) is a crucial part in building on our commitment to serve and celebrate the diverse working American families. This starts with our dedicated, hardworking… [Continue Reading]

JCPenney Beauty takes over the Dot Com Experience

For the first time in JCPenney history, jcpenney.com experienced a full homepage takeover on January 17, featuring just one category throughout the entire website: JCPenney Beauty! Since the launch of… [Continue Reading]

Urban Hydration’s I Wanna Dance, available exclusively at JCPenney Beauty

The iconic legacy of Whitney Houston lives on in the exclusive, limited edition collection, “I Wanna Dance,” by Urban Hydration – a Black and woman owned beauty brand known for… [Continue Reading]